What is Leverage?

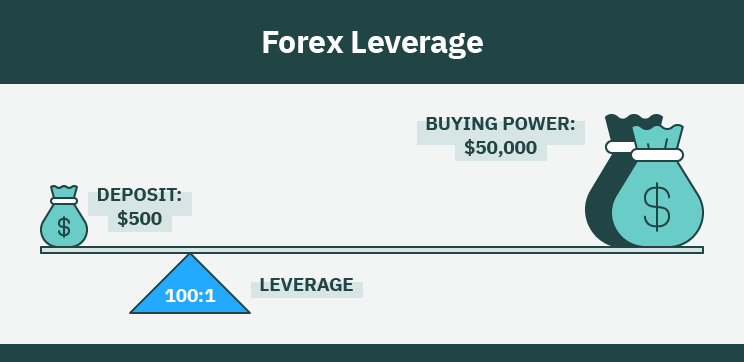

Leverage defines the margin requirement to open and maintain a Forex position. It allows traders to control larger positions with a smaller amount of capital.

What is 1:500 Leverage?

1:500 leverage is the standard for major Forex pairs, enabling traders to control $100,000 with just $200 margin.

Example:

- Trade: 0.10 standard lots EUR/USD at 1.0800

- Without leverage: Requires $10,800 to open the position

- With 1:500 leverage: Requires $21.60 margin to open the position

Key Points:

- Leverage is essential for retail Forex trading due to large trading volumes

- Higher leverage does not necessarily mean higher risk

- Understanding leverage is crucial for effective Forex trading

Trading Tips:

- Use leverage wisely to maximize trading potential

- Set proper risk management strategies to minimize losses

- Choose a reputable high-leverage Forex broker

By grasping the concept of 1:500 leverage, Forex traders can make informed decisions and optimize their trading strategies.

Understanding 1:500 Leverage

What is 1:500 Leverage?

1:500 leverage means traders need 1/500th of the total deal value as margin, enabling control of larger positions with less capital.

Example: $100,000 deal value requires $200 margin.

Is 1:500 Leverage Worth the Risk?

Leverage doesn’t increase risk; lack of risk management does. Proper risk management strategies minimize losses.

Suitable for Beginner Traders?

Only if they understand the relationship between leverage and risk management.

Pros of 1:500 Leverage:

- Decreased capital requirements

- Increased capital efficiency

- Magnified profit potential

- Ability to trade Forex

- Increased flexibility

Cons of 1:500 Leverage:

- Overtrading

- Insufficient capital

- Inappropriate trading volumes

- Missing or inadequate risk management

- Misunderstanding of leverage

Bottom Line:

1:500 leverage is standard for major Forex pairs. Traders should consider high-leverage brokers for competitive conditions. Higher leverage doesn’t equal higher risk, but proper risk management is crucial. Leverage depends on trading strategy and asset, so traders must understand it and master risk management before deciding.

Muchas gracias. ?Como puedo iniciar sesion?