Unlocking the Power of Leverage in Forex Trading

Understanding Leverage: The Key to Forex Success

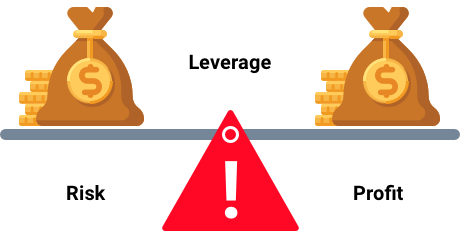

Leverage is a crucial tool in Forex trading, yet it’s often misunderstood. Let’s break down the concept and explore how to use it effectively.

What is Leverage in Forex?

Leverage shows how much money Forex brokers lend traders. The industry standard is 1:500, meaning $1 can control a $500 position.

The Risks of High Leverage

Before choosing high-leverage brokers, understand the risks:

- Lack of knowledge

- Inadequate risk management

- Misunderstanding leverage and risk

- Insufficient capital

- Overtrading

- Inappropriate trading volumes

- False trading strategy

- Miscalculating trading fees

Using Maximum vs. Less Leverage

The best leverage depends on individual circumstances. Proper risk management ensures portfolio risk remains identical with 1:1 or 1:3000 leverage. Leverage impacts how many pips a trade can move before hitting maximum loss tolerance.

Selecting the Right Leverage Level

Risk management determines leverage, followed by trading strategy. Active day traders can safely opt for maximum leverage, while others must understand leveraged trading aspects.

What Leverage Ratio is Good for Beginners?

There’s no golden rule. Traders without a strategy should not trade, as less leverage only means slower capital loss. Risk remains identical regardless of leverage settings.

Tips on Using Leverage

- Master trading psychology

- Understand leverage and risk management

- Trade with sufficient capital

- Use appropriate lot sizes

- Ensure negative balance protection

- Never hold leveraged positions overnight

High Leverage in Forex – Pros & Cons

Weigh the advantages and disadvantages:

Pros:

- Ability to trade Forex

- Increased flexibility

- Magnified profit potential

- Increased capital efficiency

- Decreased capital requirements

Cons:

- Misunderstanding leverage

- Inadequate risk management

- Flawed trading strategy

- Insufficient capital

- Overtrading

- Inappropriate trading volumes

Conclusion

Higher leverage doesn’t equal higher risk. Risk management determines risk. Traders must understand the relationship between risk management and leverage to implement appropriate settings. Leverage depends on trading strategy and asset, so master risk management before deciding on leverage.