In the fast-paced world of financial markets, having a solid trading strategy is crucial for success. Among various approaches, momentum trading strategies have gained significant traction in recent times. This article delves into the concept of momentum trading, its advanced applications, and practical examples. We will explore the best momentum indicators to utilize and guide you on how to start implementing free momentum trading strategies in a virtual environment .That’s a great point! Momentum is indeed a crucial aspect of day trading, and finding stocks that are likely to make significant moves is the key to success. You’re right that almost every day, there are stocks that experience large price movements, and identifying them before they make their move is the challenge.

Your realization that stocks that make big moves often share certain technical indicators in common is a valuable insight. By identifying these indicators and combining them with other forms of analysis, such as fundamental analysis and market context, you can increase your chances of finding stocks that are poised for significant price movements. That’s a great analogy! In physics, momentum refers to the product of an object’s mass and velocity, describing its tendency to keep moving in a straight line. Similarly, in investing and trading, momentum refers to the tendency of a security’s price to continue moving in a specific direction.

Just like an accelerating car gains momentum, a stock or asset that’s experiencing a price increase can be said to be “gaining momentum” as more investors and traders jump on the bandwagon, driving the price even higher. This concept is often used in momentum trading strategies, where the goal is to identify and ride the wave of momentum in a particular stock or asset.

By applying the physical concept of momentum to financial markets, traders and investors can better understand and capitalize on the dynamics of price movements, making more informed decisions and potentially achieving greater returns.

Momentum trading is an investment strategy that aims to profit from the direction of a stock’s price trend, whether short-term or long-term. This approach focuses on identifying and riding the momentum of a stock’s price movement, rather than buying low and selling high.

There are different types of momentum trading:

- Short-term: Focuses on quick profits from sudden price movements, often driven by news or events (e.g., earnings reports, analyst upgrades).

- Long-term (Position Trading): Involves holding stocks for an extended period, riding the momentum of a sustained uptrend (e.g., Tesla’s multi-year rise).

- Intermediate-term (Swing Trading): Seeks to capture shorter-term price movements, typically holding stocks for days or weeks.

- Day Trading: The shortest-term approach, aiming to profit from intraday price movements.

The core principle of momentum trading is to “buy high, sell even higher,” capitalizing on the direction and magnitude of a stock’s price trend. This strategy requires a deep understanding of technical analysis, market dynamics, and risk management.

Some common technical indicators that may be useful in identifying potential momentum stocks include:

- Relative Strength Index (RSI)

- Bollinger Bands

- Moving Averages

- MACD (Moving Average Convergence Divergence)

- Volume indicators

It’s also important to keep in mind that no single indicator is foolproof, and it’s always best to use a combination of indicators and analysis techniques to confirm your findings.

What is Momentum trading Style .

Momentum trading is a straightforward approach where traders capitalize on the strength of an asset’s recent price action. The underlying principle is that a strong price movement is likely to persist for a while, making it a profitable opportunity.

This trading style has gained popularity due to the evolving nature of markets. Sophisticated algorithms quickly identify assets showing signs of strength and join the trend, attracting more traders and creating a self-reinforcing momentum. Most momentum traders operate within established trends, leveraging the “herd mentality” and “fear of missing out” to their advantage.

It’s important to note that momentum strategies differ from contrarian and reversal approaches. But do they work? Let’s explore some examples!

Additionally, you can download the Meta Trader 5 trading platform from Admirals for free, which offers advanced features, direct trading from charts, and expert tools to help you identify the best momentum markets to trade.

Momentum trading can be likened to a moving car, making it easier to comprehend. Let’s break it down:

- Acceleration: Identify a stock with a rising price, just like a car starting to move forward. The initial speed is slow, but as the stock continues to gain momentum, its price increases.

- Gaining speed: As the car accelerates, its speed increases, similar to how your investment grows as the stock’s price continues to rise.

- Deceleration: When the car approaches a red traffic signal, it slows down, just like when the stock’s momentum begins to fade. This is your cue to exit your position at a profit.

This analogy illustrates the core concept of momentum trading: identifying and riding the wave of a stock’s price increase, and exiting when the momentum slows.

Momentum traders seek assets with significant price movements over a defined period, focusing on strong upward (bullish) or downward (bearish) trends. To confirm momentum and identify entry and exit points, they employ technical indicators such as:

- Moving Averages

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Stochastic Oscillators

These indicators help traders gauge the strength and direction of price trends.

Entry and Exit Criteria

Momentum traders establish specific criteria for entering and exiting trades based on their chosen indicators and strategy. For example:

- Entering a long position (buy) when the price breaks above a moving average or RSI indicates oversold conditions

- Entering a short position (sell) when the price breaks below a moving average or RSI indicates overbought conditions

Risk Management and Position Sizing

Effective risk management is crucial in momentum trading to protect against losses. Traders:

- Set stop-loss orders to limit potential losses

- Use position sizing techniques to manage capital allocation relative to their portfolio size and risk tolerance

Adapting to Changing Market Conditions

Momentum traders continuously assess market conditions and adjust their strategies to:

- Capitalize on new opportunities

- Mitigate risks

- Remain flexible and responsive to changes in price trends, volatility, and other market factors

By following these principles, momentum traders can effectively identify and capitalize on strong price trends while managing risk and adapting to changing market conditions.

Time-Series Momentum

- Assesses individual assets’ historical performance over a specific period (e.g., 3, 6, or 12 months)

- Identifies assets that have achieved a certain percentage profit threshold (e.g., 10% over 6 months)

- Buys assets exceeding this threshold, anticipating continued positive momentum

- Focuses solely on each asset’s performance relative to its own historical performance

Cross-Sectional Momentum

- Compares assets’ performance relative to each other within a portfolio or universe of assets

- Ranks assets based on recent performance (e.g., returns over 3 months)

- Buys top-performing assets (e.g., top 10) and sells or avoids bottom-performing assets

- Focuses on selecting assets with the strongest relative performance compared to their peers

In summary, time-series momentum strategies evaluate individual assets based on their historical performance, while cross-sectional momentum strategies compare assets’ performance relative to each other. Both approaches aim to capitalize on trends and momentum, but their differing perspectives can lead to distinct trading decisions.

Effective Momentum Trading Strategies: Leveraging Indicators for Success

Momentum trading strategies rely on indicators to identify strong price moves and potential trend continuations. The best strategies adapt to different asset classes and market conditions. Here are some most popular Forex momentum trading strategies:

- Stock and Share Momentum: Volume indicators are commonly used to gauge market participation and confirm price moves.

- FX Momentum Trading Strategies: The 24-hour Forex market and algorithmic trading robots create ideal conditions for momentum trading. Popular indicators include:

- Relative Strength Index (RSI)

- Moving Average indicator

- Combination of both for versatility and confirmation

- RSI and Moving Average Combination: This strategy suits longer-term charts and day trading approaches, offering flexibility and reliability.

- Trend Confirmation: Use multiple indicators to confirm the strength and direction of a trend, increasing the likelihood of successful trades.

- Adaptive Strategies: Adjust your approach according to market conditions, such as switching between indicators or modifying parameters to suit changing volatility and trend dynamics.

- Risk Management: Always prioritize risk management techniques, like position sizing and stop-loss orders, to protect your capital and maximize returns.

By combining these strategies and adapting to market conditions, you can develop a robust momentum trading approach that captures profitable trends and minimizes losses.

Optimizing Momentum Trading: Understanding Market Environment and Strategy Selection

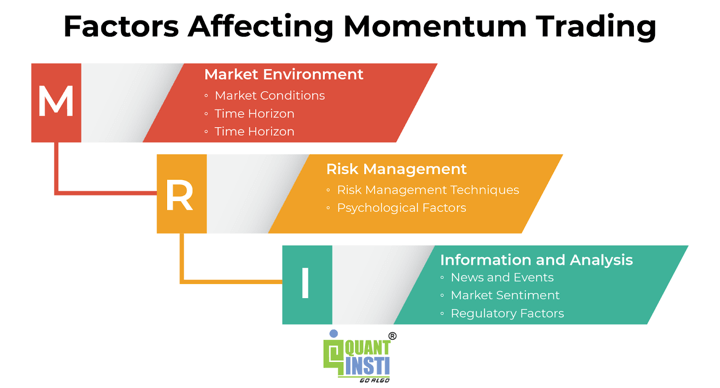

Momentum trading success depends on adapting to the market environment and selecting the right strategies. Key factors to consider:

Market Conditions

- Trends: Strong trends with low volatility create favorable conditions for momentum strategies

- Volatility: High volatility can lead to false signals and challenges for momentum traders

- Liquidity: Adequate liquidity is crucial for efficient trading and minimizing slippage

Time Horizon

- Short-term (minutes to hours): Capture frequent, smaller price movements

- Medium-term (hours to days): Balance risk and reward in trending markets

- Long-term (days to weeks): Capitalize on significant trends, but be prepared for potential reversals

Asset Selection

- Choose assets with clear and persistent trends

- Consider asset-specific characteristics, such as volatility and momentum profiles

By understanding the market environment and selecting the right strategies, traders can optimize their momentum trading approach and maximize returns while minimizing risk.

Here’s what you need to know about momentum trading strategies ¹ ²:

News and Events:

- Economic data releases and geopolitical events can impact asset prices and disrupt existing trends.

- Event-driven momentum traders may actively trade around specific catalysts to capitalize on short-term price movements.

Key Momentum Trading Strategies:

- Key Indicators and Patterns Beyond Flag Breakouts:

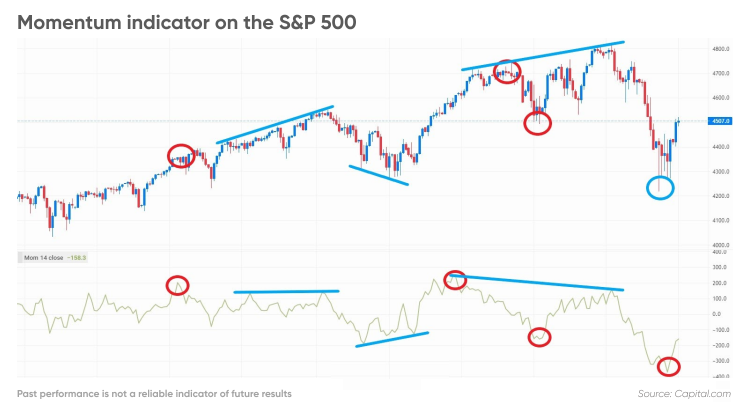

- Bollinger Bands: This tool measures market volatility and provides relative boundaries of highs and lows.

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements, helping identify overbought or oversold conditions which can precede a momentum shift.